"Liberation Days" is a zero-sum game for us, or will a new leader emerge?

It's been a tough week for the global market, especially after the New Supreme Leader of the USA announced that he would impose tariffs on all goods imported to the US.

What's liberation days mean for all global investors? based on my perception, this is still the tug of war between US the current world supremacy vs China the contender of world supremacy. US as the #1 leader in financial market who its competitive advantage is USD, will send the inflation to the rest of the world by implementing tariff to all imported goods. In the forex and bond markets, the US dollar index

remained steady above 104, and the 10-year US Treasury yield stayed at 4.25%. Japan’s 10-year bond yield hit a new high since 2000. If Indonesia market open, I guess our IDR could be shooting up to IDR17,000 due to market risk off and potential of more sell of Indonesia market. But dont you worry, our market is not open so circuit breaker will not be happen and I think, during the market open next week, we might just have one gap down before market is pricing in some Trump liberation day mood.

While we expect the Trump administration to continue expressing frustration over China, there are several recent examples that illustrate this. For instance, JD Vance's impulsive trip to Greenland garnered little attention in Europe. Additionally, Trump has threatened Iran if they refuse to engage in negotiations regarding the nuclear issue. He also expressed anger towards Putin if Russia does not agree to end the ceasefire. There are ongoing tensions between the U.S. and China regarding the South China Sea, as well as U.S.-Taiwan relations that have drawn criticism from China’s Foreign Affairs Minister. Overall, this news suggests that the "bully" is frustrated because the "NERDS" are receiving all the global attention.

On a positive note, China continues to generate encouraging news. For instance, more scientists are returning to China from the U.S. due to experiences of "racism" at some universities. Additionally, there are developments such as BYD’s supercharger and the introduction of a new stealth fighter by the PLA. This news creates a sense of positive energy coming from China, while, in contrast, the sentiment in the U.S. feels marked by anger and negativity.

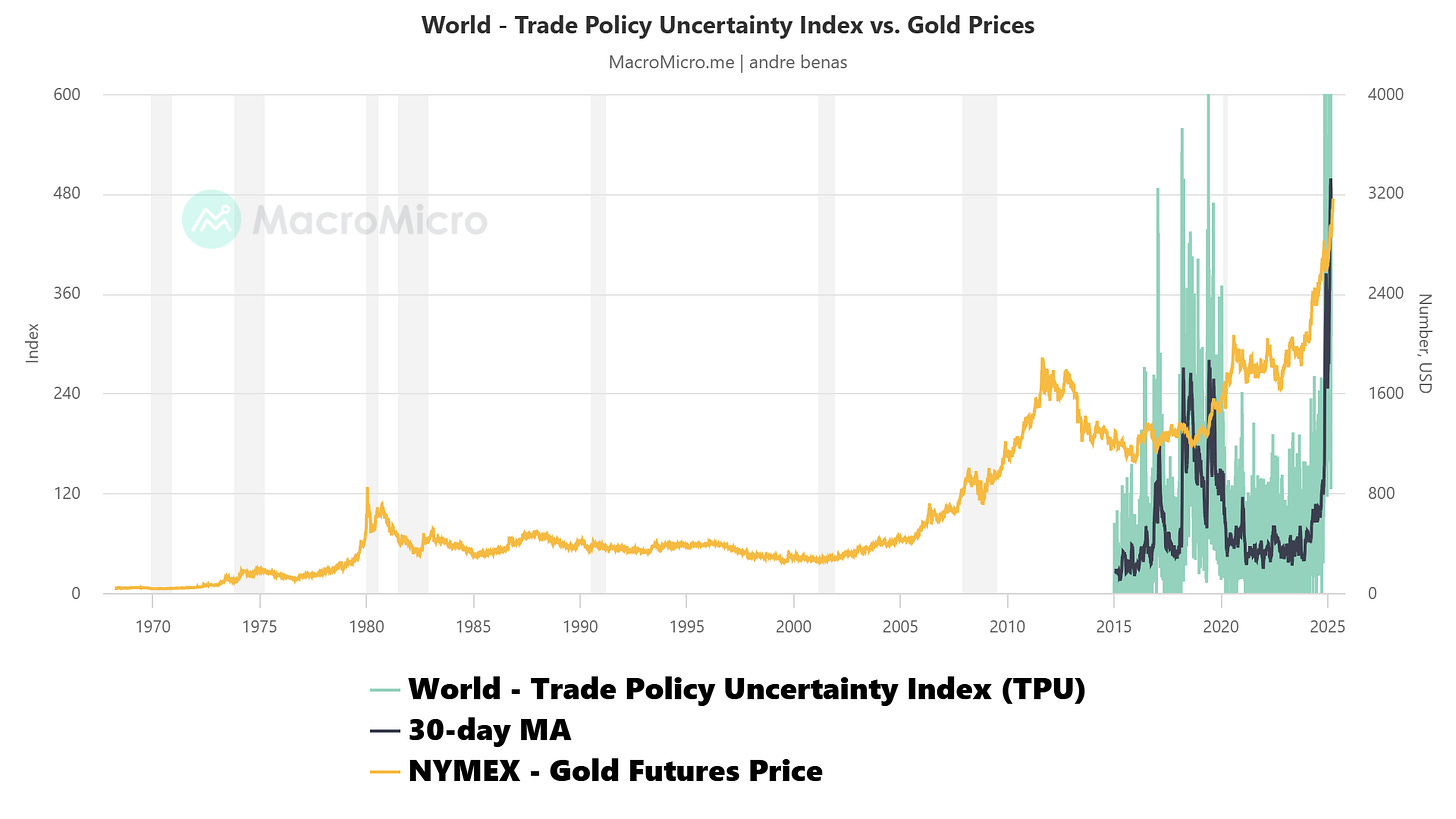

Gold has risen to $3,000, reflecting uncertainty and serving as a hedge against inflation. The market seems to be scrambling for safe havens as interest rates are expected to remain high due to the tariff war and the potential decoupling of financial assets from the USD in favor of gold-pegged assets. While Generation Z still views Bitcoin (BTC) as the best bet against inflation, the persistently high interest rates and the anticipated shift of more BRICS countries toward non-USD assets suggest that gold is likely to perform better in the coming months. Additionally, the theme of stagflation is expected to continue due to tighter inventories and the rise of the Chinese electric vehicle (EV) market.

What’s the outlook for the Indonesian market next week as it opens? Personally, I don’t see any fundamental changes during the Lebaran week. The news is still focused on traffic congestion due to Lebaran, which could generate positive sentiment for toll roads. However, retail sales have been sluggish—there’s no confirmation yet, but it remains to be seen. Additionally, we are facing negative political news and podcasts.

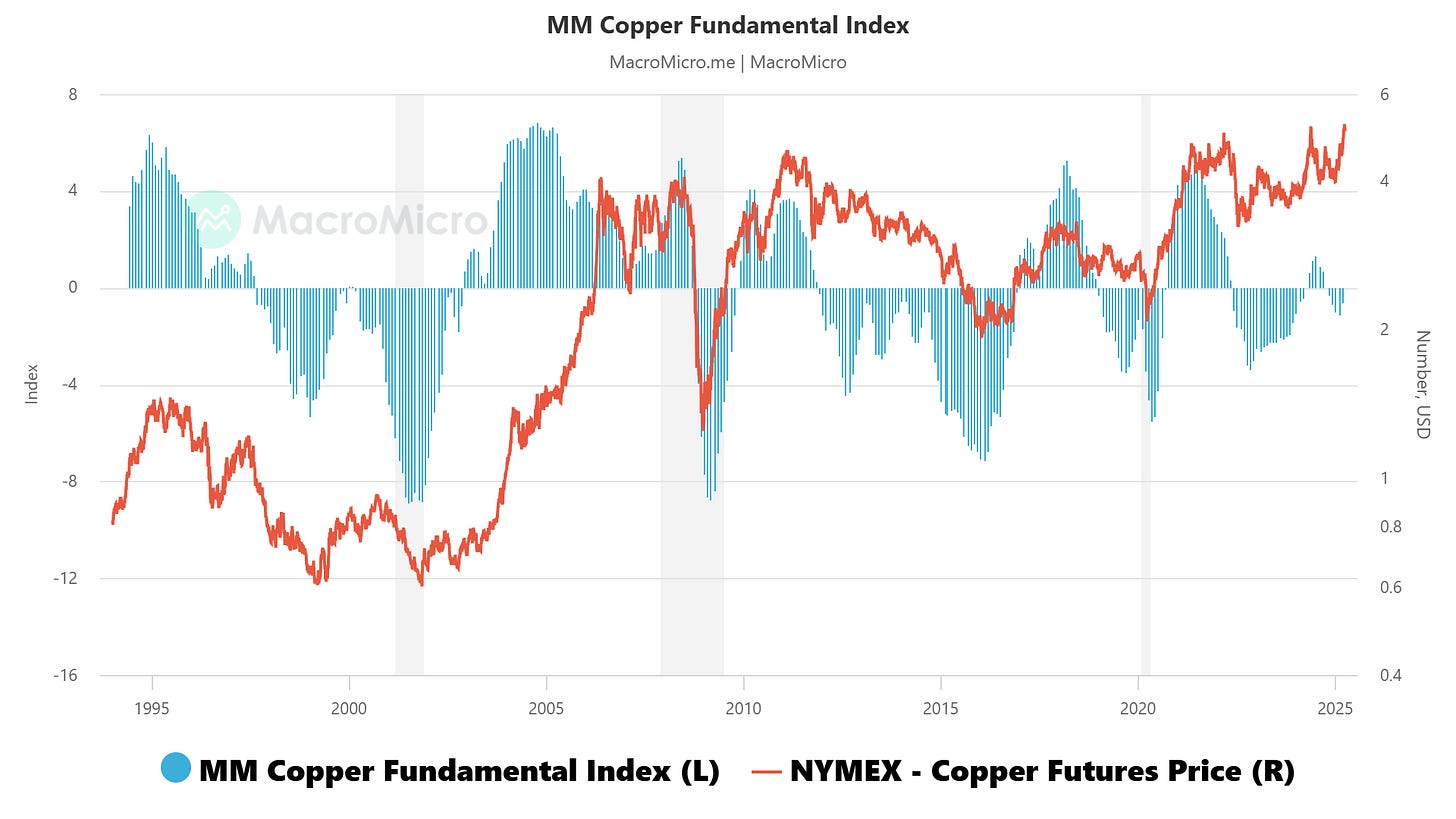

Given this news environment, I don’t expect banks to rebound significantly due to risk-off sentiment and the risks associated with the Indonesian Rupiah (IDR) amid the USD and tariff war. Personally, I would prefer to stay in cash or invest in gold, metals, or copper-related stocks. However, it’s important not to be too aggressive, as we could face further downside pressure from geopolitical risks. Indonesia is relatively small for foreign investors, so I doubt they will seize aggressive opportunities here, aside from local companies that may actively buy back their shares.

This is my personal view, so please use it at your discretion. Happy holidays, and see you in two weeks!